Mastering the Derivatives Market

The F&O segment requires speed, precision, and strict risk control. Our advisory service is tailored for active traders, providing high-probability trade setups in Equity Futures and Options, focusing keenly on preserving capital.

What You Receive

- High-Frequency Calls: Timely recommendations for both Index and Stock Futures/Options.

- Strict Risk-Reward Ratio: Every trade includes a non-negotiable stop-loss and multiple profit booking targets.

- Intraday to Positional Strategy: Coverage for quick intraday moves and short-term positional contracts.

- Strategy & Hedging Insights: Guidance on optimal option strategies (e.g., spreads) for market conditions and hedging needs.

Importance of Risk Management

Due to the leveraged nature of derivatives, we place paramount importance on risk management. Our recommendations are designed to ensure that potential losses are always capped, allowing for sustainable growth over time.

Ideal for: Experienced traders comfortable with the high risk and margin requirements of the Futures and Options segment.

Subscription Fee (Silver Plan Example)

₹35,000 / Quarter (Inclusive of GST)

Plan Highlights:

- Equity: Cash + Futures research access

- Well-defined entry and stop-loss levels for F&O

- Moderate frequency of recommendations

- Weekly market outlook reports

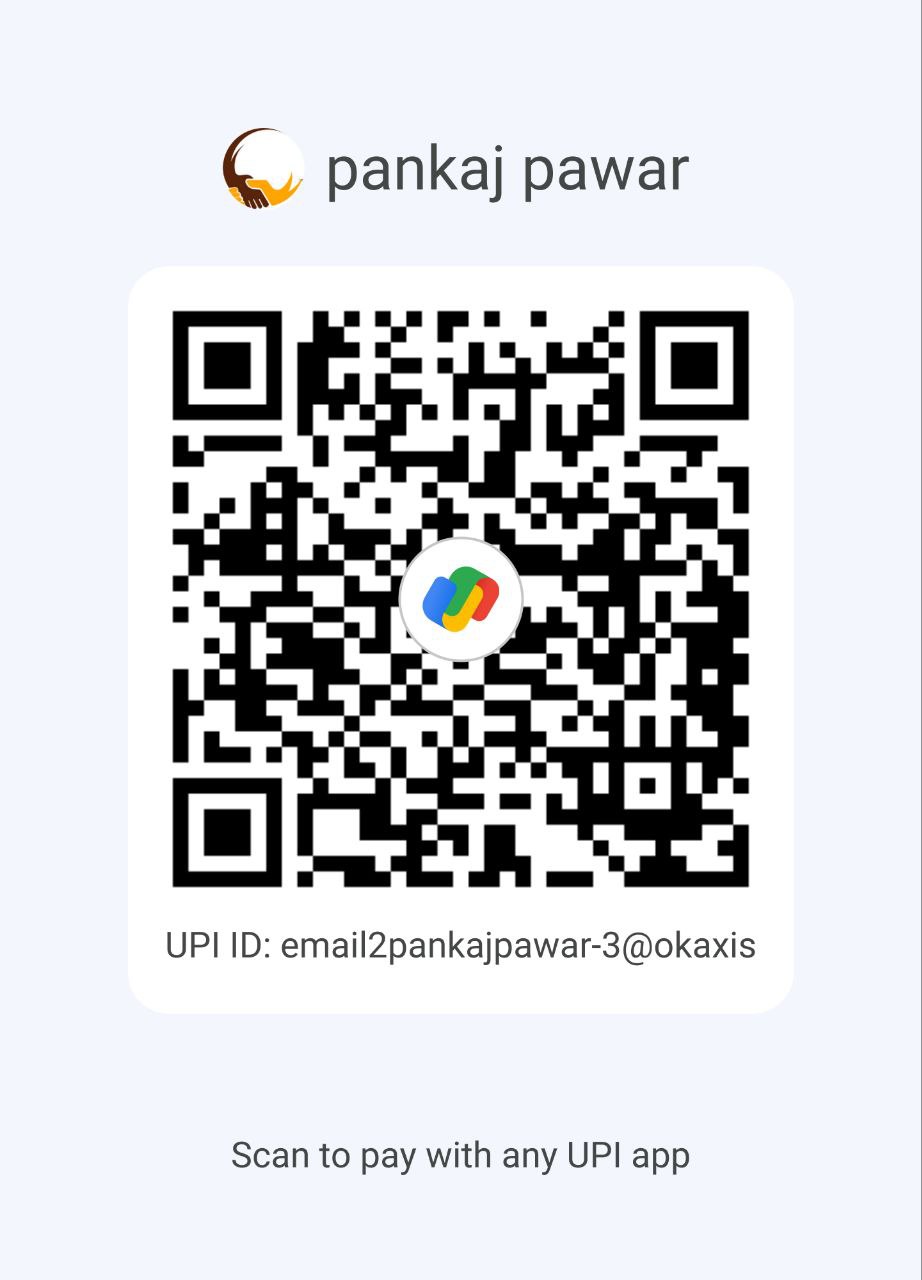

IMPORTANT: All payments must be made exclusively to the official CapitalLyft bank account listed on our Regulatory

Disclosure page. Do not transfer funds to any other account.