Navigating the Global Commodity Market

Commodity markets are highly sensitive to global economic and geopolitical events. Our specialized service provides timely and strategic advice on key commodity futures and options contracts, helping you capitalize on macro trends while managing volatility.

What You Receive

- Targeted Commodity Calls: Focus on major contracts like Gold, Silver, Crude Oil, Natural Gas, etc.

- Macro-Economic Analysis: Insights driven by global supply/demand dynamics, currency fluctuations, and geopolitical events.

- Intraday and Positional Calls: Strategies for high-liquidity intraday trading and medium-term positional calls based on fundamental shifts.

- Rigorous Risk Management: Strict stop-loss levels are provided for every recommendation to protect capital in the highly leveraged commodity segment.

Expertise in Commodity Drivers

We understand that commodities are driven by factors distinct from equity markets. Our research integrates specific drivers, including inventory data, economic reports, and currency strength, to generate high-quality trading signals.

Ideal for: Traders looking to diversify their portfolio and capitalize on trends in the Indian commodity derivatives market.

Subscription Fee (Gold Plan Example)

70,000 / Half-Yearly (Inclusive of GST)

Plan Highlights:

- Full access to Equity and Commodity F&O research

- High-probability trade setups

- Sectoral/Commodity specific insights

- Dedicated communication support

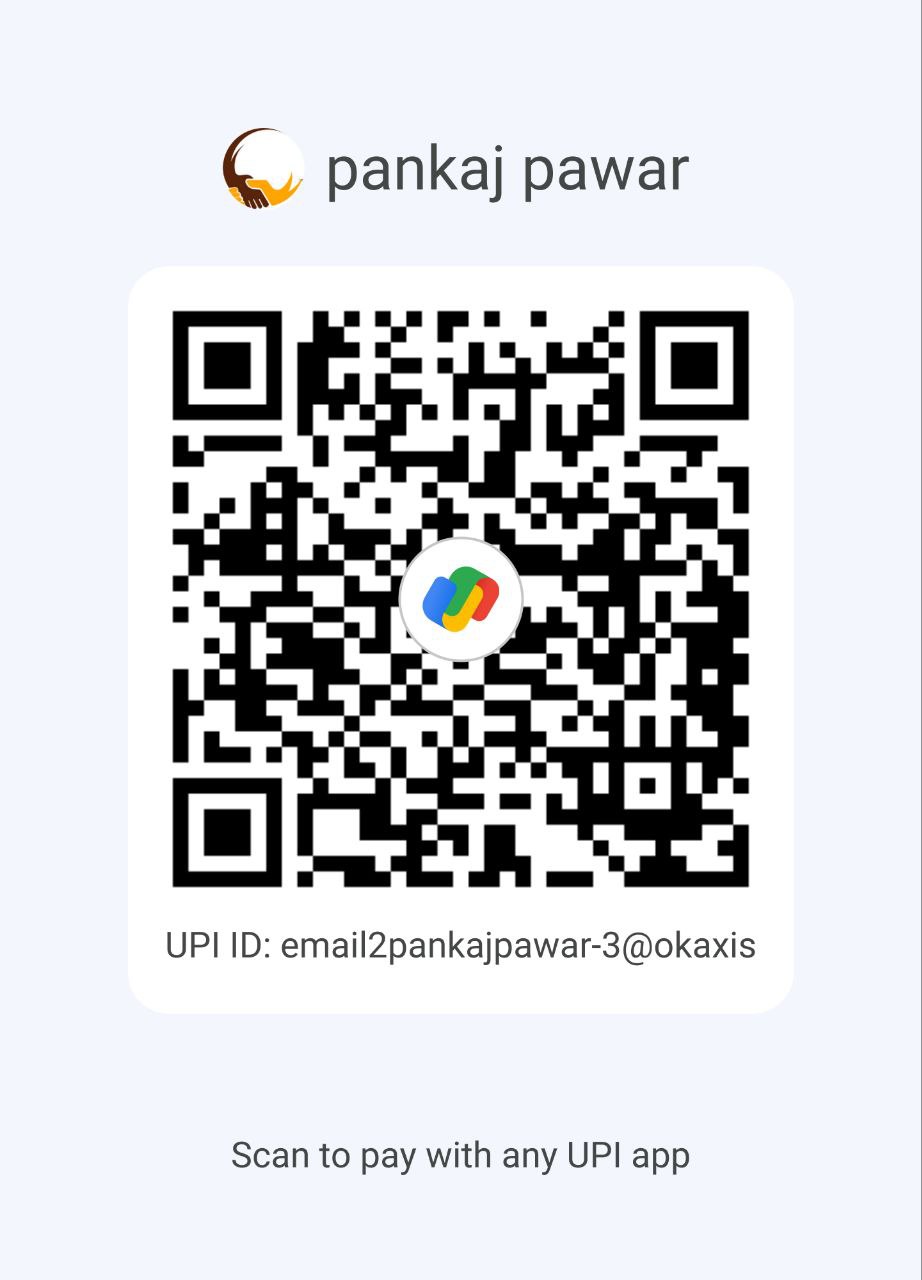

IMPORTANT: All payments must be made exclusively to the official CapitalLyft bank account listed on our Regulatory

Disclosure page. Do not transfer funds to any other account.